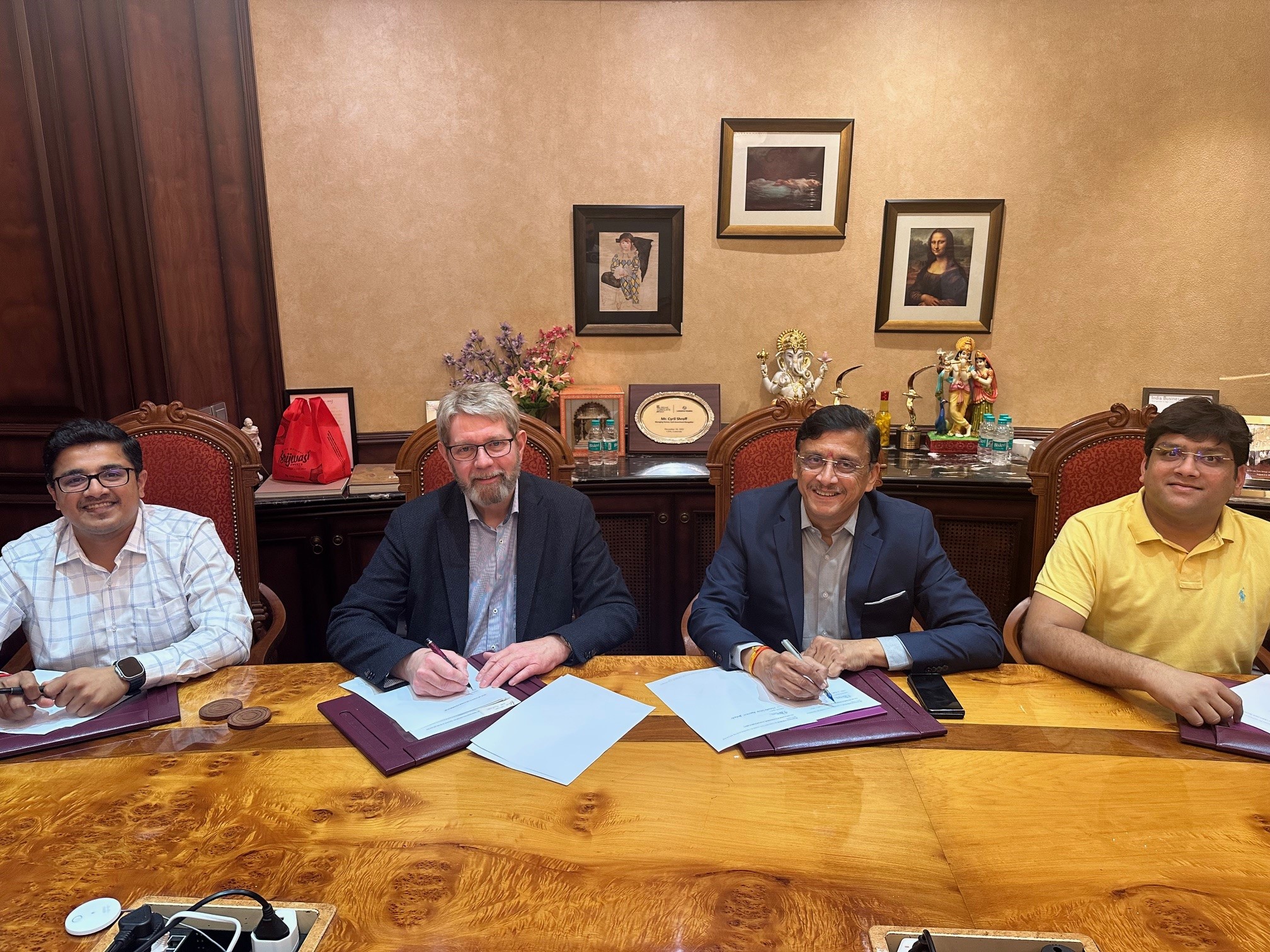

Hampidjan hf. has signed an agreement to acquire a 75.1% stake in the Indian net and rope manufacturing company Kohinoor Ropes Pvt. Ltd.

Kohinoor’s rope and net factory in Selu is approximately 35,000 m².

Kohinoor is one of the largest manufacturers of nets and ropes in India. The company employs over 700 people and operates three facilities: two net and rope factories in Selu and a net workshop in Jalna. It also has an office in Aurangabad. Following the acquisition, the total number of employees within the Hampidjan Group will reach approximately 2,700. The current owners of Kohinoor, which has been a close partner of the Hampidjan Group for years, will retain a 24.9% stake in the company. Last year, Hampidjan was Kohinoor’s largest single customer, as a significant portion of the twisted ropes used by Hampidjan come from Kohinoor.

Production of fish farming cages in Jalna.

Collaboration has also been growing rapidly in aquaculture-related products, particularly in the production of fish farming cages.

For Hampidjan, this acquisition presents significant opportunities for operational efficiencies and expansion into new markets. The company’s value chain, from plastic granules to state-of-the-art trawls and aquaculture cages, will be further strengthened by this acquisition, as currently, one-third of the ropes used by the Hampidjan Group come from Kohinoor. Hampidjan’s global presence will open new sales channels for Kohinoor’s products and enhance the product range offered by Hampidjan’s subsidiaries.

With the acquisition of Kohinoor, Hampidjan gains access to markets that were previously less accessible due to geographical distance from Europe and high production costs there. Kohinoor has achieved remarkable success in Chile, the world’s second-largest salmon-producing country after Norway, and the acquisition will facilitate greater access to aquaculture markets in the Middle East, where Hampidjan’s subsidiary, Mørenot Aquaculture, has been involved in large fish farming projects in recent years. Additionally, there are opportunities in Asia and Oceania, where Hampidjan operates through its subsidiaries, Hampidjan New Zealand and Hampidjan Australia.

CEO Hjörtur Erlendsson stated:

“The acquisition of the majority stake in Kohinoor will increase Hampidjan’s competitiveness and increase our chances of being one step ahead of our competitors in the coming years with the optimization that can be achieved in a short time. We look forward to work with our valued parner, Kohinoor, in the years to come.

It will be possible to transfer purchases of products that Kohinoor produces, which are currently purchased from other rope and net manufacturers, and capture in full the margin that is in the value chain. Kohinoor’s product offering will increase the product range of Hampidjan’s companies around the world and simultainously increase Kohinoor’s access to the markets in which we already operate, Kohinoor’s production volume will increase and increased margins will also be created in Hampidjan’s subsidiaries.

Transferring production to India will involve considerable optimization because the production environment in India is very favorable, land for construction is available at favorable prices and construction costs are a fraction of what they are in Lithuania, not to mention Iceland. The cost of raw materials is significantly lower than we are used to in Europe for the same types of raw materials.

The biggest difference, however, is the labor cost, which is really the most important for us, because the production of materials for fishing gear and fish farming pens is labor-intensive, especially when it comes to assembling fishing gear and fish farming pens. Labor costs in India are significantly lower than in comparable jobs in Europe.

With this combined, we can gain an advantage over our competitors and also use this position to enter new and foreign markets that we have not sold much to until now.

There are therefore exciting times ahead for us in the Hampiðjan group and it is a big challenge to make the most of this position in the coming months and achieve efficiency in the autumn, which will then pay off to a greater extent next year.